Baker Manufacturing Meets the Taxman

If you drive a car, I’ll tax the street;

If you try to sit, I’ll tax your seat;

If you get too cold, I’ll tax the heat;

If you take a walk, I’ll tax your feet.

— The Beatles, “Taxman” (1966)

Up next in our series of posts covering lawsuits featuring Evansville is this case from the Truman presidency.

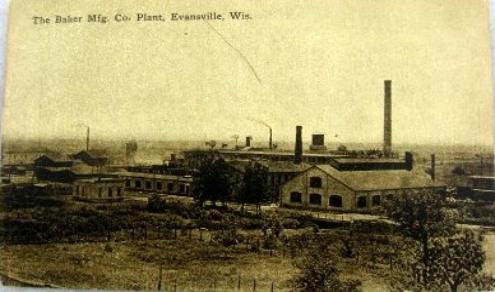

Baker Manufacturing Company, founded in the early 1870s, has been long been a bedrock of Evansville. Generations of locals have worked there and I’m sure many of our city councils have enjoyed Baker’s leadership position as far as Evansville’s tax base in concerned. But just after World War II, it looks like the Evansville taxman got a little greedy.

The dispute started in 1949 when the city, for tax purposes, assessed Baker’s personal property at 60 percent of its full value. When Baker learned that the rest of the town’s personal property had been assessed at 35 percent, however, this justifiably caused Baker to go “WTF” and call a Zack Morris timeout on the city (note: research could not confirm that Baker President John Gordon Baker actually used these terms in 1949).

When Baker challenged the city, the parties first duked it out at a meeting on August 23, 1949. When Baker tried to question the city assessor on why he assessed Baker at a higher rate than everyone else, Evansville’s city attorney shut down the questioning by arguing that state statute protected the assessor from having to answer Baker’s questions. Unsurprisingly, the meeting went nowhere and the issue remained unresolved.

The parties met again, informally, a month later. This meeting was “filled with recrimination and ending in a wrangle and abrupt adjournment,” according to the Wisconsin Supreme Court (spoiler alert: this case ends up at the Wisconsin Supreme Court).

A month after that, the city gave Baker ten hours’ notice–state statute required at least 48 hours’ notice–that it would hold a formal meeting that night to decide the issue. Baker and its attorney didn’t show up and in a shocking turn of events, the city determined that its tax assessor had been right all along.

Apparently the city felt the need to prove the old adage that “pigs get fat, hogs get slaughtered,” so the following year it assessed Baker’s real estate at 100 percent of its value and assessed the rest of the town’s real estate at between 60 and 70 percent of its value. To add insult to injury, the city also started taxing Baker property that it had not taxed in previous years (surely this had nothing to do with the fact that 1949 and 1950 were some of the most profitable years in Baker’s history and surely the city wasn’t interested in getting a piece of those profits for itself). The parties repeated the previous year’s farce, with the city attorney again not allowing the assessor to answer questions regarding how he decided to tax Baker at a higher rate than anyone else or start taxing property that had never been taxed before. After the hearings, the city again determining that the assessor was in the right.

Baker decided enough was enough and sued the city. The case ultimately ended up in the Wisconsin Supreme Court, where the court declined to rule. Instead, it took shots at both parties–Evansville for acting arbitrarily and refusing to explain why it did so and Baker for having its attorney act as both an advocate and a witness in the case–before ultimately sending the case back to the lower court to be decided. What happened in the lower court isn’t clear, but one assumes that the parties settled the issue and, fortunately, the parties have avoided court in the 65 years since.

People + business + government + $$$$$ = lawyers.

Nice to know you’ll always have work, eh?