A Letter to Potential Land Contract Vendors and Vendees.

/

0 Comments

Dear Potential Land Contract Vendors and Vendees:

There…

What gives an LLC the “guts” it needs to stand up to the mighty “veil piercing” law suit

Here are some short but quick tips on setting up a solid LLC.

File…

Walter Shannon

Walter ShannonTalking Point: Donating your IRA or other Qualified Plan to Charity Upon Death

If I am already wanting to make a charitable gift, does it make…

How do I Open and Manage a Probate?

The probate process in Wisconsin can be complicated. There…

Who gets the personal property when the Family Cabin is sold?

It is not silly to think about this topic.

In fact, it is…

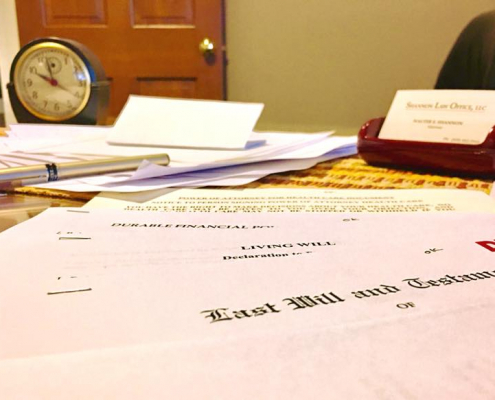

Does an Agent’s Authority under a Wisconsin Durable Financial Power of Attorney end when the Principle dies?

Answer: Yes. The Agent's authority dies when the principle…

Should I tell my insurance agent that my house is going into my trust?

Yes indeed. You need to contact your insurance agent…

What is a Wisconsin Transfer on Death Deed?

What is a transfer on death deed? A transfer-on-death…

Contentious Probate Settled – Kudos to the Family Involved

One of the hardest things to deal with in life is the…

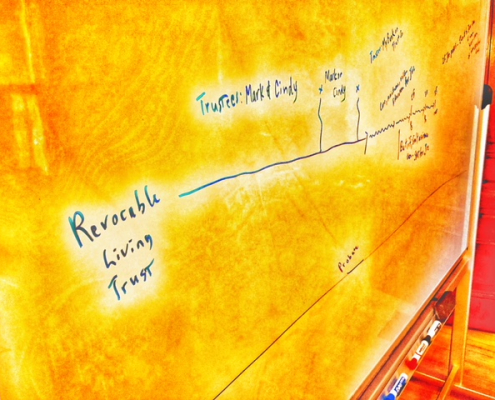

Revocable living trust and pour over will. Why do I need both?

The Question. Why do we have a pour over will when we…

News Flash: Beneficiary designations are a Big Deal

Use Care: Beneficiary Designations Override Your Will…

Land Contracts in Wisconsin: What are they?

What is a Land Contract

A land contract is a form…

Walter Shannon

Walter ShannonEstate and Trust Planning: Going Beyond Just the Numbers and into the Heart

The clinical truth...

Estate planning professionals are taught…

Social Media Warning: Consider the consequences before you type something mean about another person

We received a call from a client who was on the wrong…

Choosing an Attorney for Your Estate Planning

A recent Caring.com article by Susan Kostal, Senior…