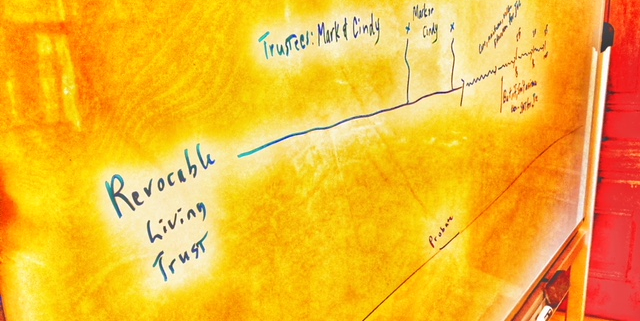

Revocable living trust and pour over will. Why do I need both?

The Question. Why do we have a pour over will when we already have a revocable living trust in our estate plan? Isn’t that repetitive?

Let’s try to answer this age old question.

Quick clarification. Your Trust is the Boss. Your trust is your featured/ main estate planning tool used to move your assets to the next generation. After you develop your trust document …you add your assets into your trust. This is accomplished by changing the title of the property into the name of the trust or by setting the trust in as the beneficiary of a certain asset. (IE: life insurance). Then, when you die, the assets stay in the trust avoiding the need for a probate of the assets it holds on your behalf.

Your pour over will (Called “pour over” because it names the trust as beneficiary) should be a smaller player in the whole scheme of things, but it is a necessary role player.

Here are three reasons why a pour over will is still necessary….

1. Guardians. A pour over will can do important things that a living trust document cannot do. If you have minor children and want to name a guardian for them — someone to raise them if you and the other parent die before they reach adulthood — you must use a will to do that.

2. Human Error. Lets face it. We all make mistakes. One big reason to write a pour over will is that a living trust covers only property you have transferred, in writing, to the trust. Almost no one transfers everything to a trust. And even if you do scrupulously try to transfer everything, there’s always the chance that you’ll acquire property shortly before you die and not have time to put it into your trust. If you don’t think to (or aren’t able to) transfer ownership of an asset to your living trust, it won’t pass under the terms of the trust document. Anything not transferred into your trust prior to your death could instead be subject to probate and distributed under your pour over will. In short, a pour over will acts as a safety net and sends a “forgotten asset” back into your trust.

3. Satisfying the rules for paying a decedent’s last bills. The law says that an estate pays the last bills. The pour over will contains language that passes that statutory obligation from the Personal Representative of an empty estate to the trustee under the trust. This language, coupled with special language accepting the responsibility under the trust, make the bill paying process seamless.

Of course, there is more to all of this. The key for anyone with a trust is to seek counsel. Get your questions answered. Also know that a trust is a beautiful thing, but it never acts alone. It always needs the reliable sidekick called a “pour over will” in order to accomplish its mission.

Leave a Reply

Want to join the discussion?Feel free to contribute!