Tag Archive for: estate planning

Contentious Probate Settled – Kudos to the Family Involved

/

0 Comments

One of the hardest things to deal with in life is the…

Revocable living trust and pour over will. Why do I need both?

The Question. Why do we have a pour over will when we…

News Flash: Beneficiary designations are a Big Deal

Use Care: Beneficiary Designations Override Your Will…

Conservation Easement: A Beautiful Thing

What are these?

A conservation easement is an interest in real…

News Flash: Few People Actually Plan for Death or Incapacity

Estate Planning Note:

AARP shared an article…

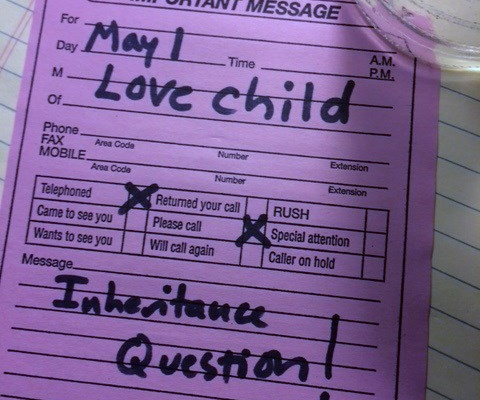

What if Prince has a “Love Child”? Then What?

We hear it over and over. A famous person does not have a will…

https://shannon-law.com/wp-content/uploads/grunge-books.jpg

640

480

Walter Shannon

https://s3.amazonaws.com/shannon-law.com/wp-content/uploads/20190821102841/logo-rebuild.gif

Walter Shannon2016-04-12 20:48:012019-11-27 11:36:59Got Will?

https://shannon-law.com/wp-content/uploads/grunge-books.jpg

640

480

Walter Shannon

https://s3.amazonaws.com/shannon-law.com/wp-content/uploads/20190821102841/logo-rebuild.gif

Walter Shannon2016-04-12 20:48:012019-11-27 11:36:59Got Will?

Revocable Living Trusts: Are We Funded Yet?

The Review

We recently had a new client present us with her…

Why Use an Attorney for Your Will When You Can Download One for Free?

There are certainly forms out there on the internet or on a book…

Transfer-On-Death Deed: The Best Thing Since Sliced Bread

A transfer-on-death deed, or TOD deed has proven to be a simple,…