Tag Archive for: revocable living trust

Revocable living trust and pour over will. Why do I need both?

/

0 Comments

The Question. Why do we have a pour over will when we…

Choosing an Attorney for Your Estate Planning

A recent Caring.com article by Susan Kostal, Senior…

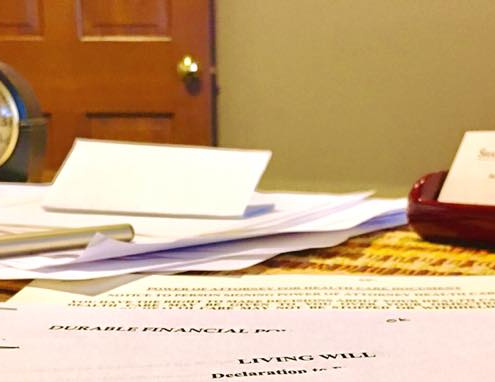

News Flash: Few People Actually Plan for Death or Incapacity

Estate Planning Note:

AARP shared an article…

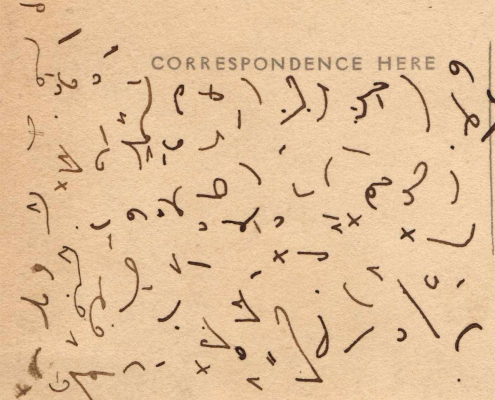

Why did you put Latin in my Will and Trust?

The legal phrases: “by representation”, "per stirpes",…

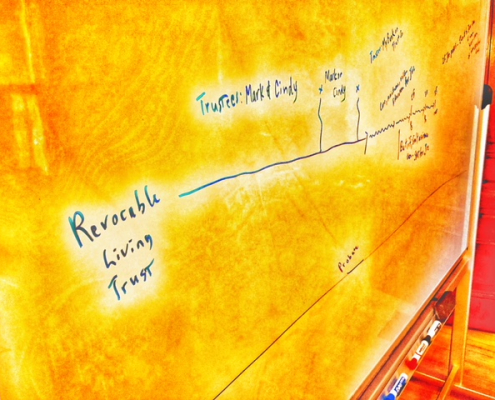

Trusts: How Do I Ascertain the Ascertainable?

We draft revocable living trusts on a regular basis here at Shannon…

Revocable Living Trusts: Are We Funded Yet?

The Review

We recently had a new client present us with her…