Tag Archive for: wills

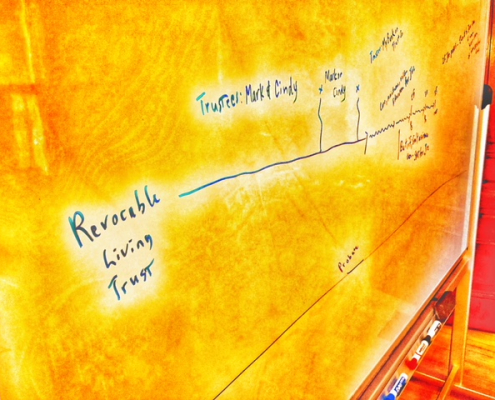

Revocable living trust and pour over will. Why do I need both?

/

0 Comments

The Question. Why do we have a pour over will when we…

Choosing an Attorney for Your Estate Planning

A recent Caring.com article by Susan Kostal, Senior…

Why Use an Attorney for Your Will When You Can Download One for Free?

There are certainly forms out there on the internet or on a book…