Tag Archive for: wisconsin estate planning

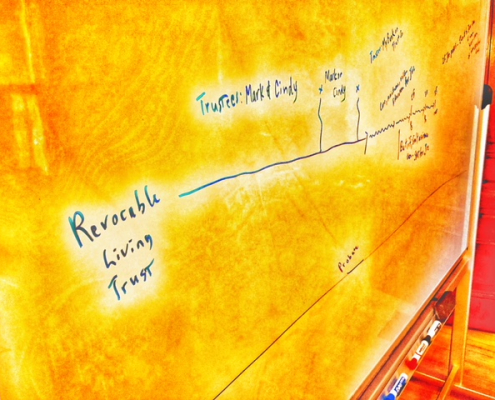

Revocable living trust and pour over will. Why do I need both?

/

0 Comments

The Question. Why do we have a pour over will when we…

Choosing an Attorney for Your Estate Planning

A recent Caring.com article by Susan Kostal, Senior…

Revocable Living Trusts: Are We Funded Yet?

The Review

We recently had a new client present us with her…