Tag Archive for: wisconsin

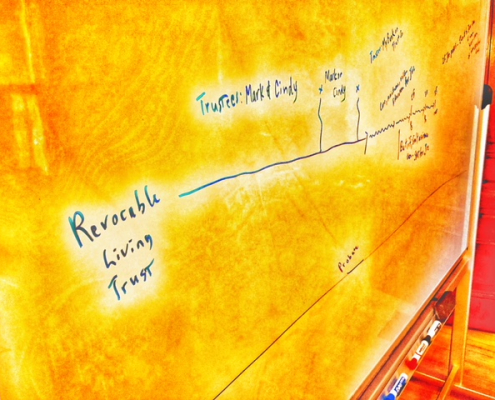

Revocable living trust and pour over will. Why do I need both?

/

0 Comments

The Question. Why do we have a pour over will when we…

What is a Guardian ad Litem?

Many parents handle their family law matters without an attorney…

Wisconsin Child Support Changes in the Works

Whether it's part of a divorce or a standalone custody matter,…

Compressed Tax Brackets on Irrevocable Trusts

What is this rumor I have heard about compressed tax brackets…

Get What You’re Owed From Your Old Job

When someone leaves a job, especially when it's on bad terms,…

What To Do When You’re Arrested

We don't do criminal law here at Shannon Law, but that doesn't…

Living without Legal Capacity: Powers of Attorney and Guardianship – What does it all mean?

What happens if you are in an accident and, due to that accident,…

Baker Manufacturing Meets the Taxman

If you drive a car, I'll tax the street;

If you try to sit,…

Transfer-On-Death Deed: The Best Thing Since Sliced Bread

A transfer-on-death deed, or TOD deed has proven to be a simple,…

Is a Cottage Limited Liability Company Right for You?

The family cottage is a location where good memories are made. …