Get Tax Credits for Work on Your Historic Home

As I drive around Evansville and see work being done on historic homes, I know that there’s a pretty good chance that the owner is leaving money on the table. Don’t let that be you.

If you live in a historic home, Wisconsin’s Homeowners’ Tax Credit program allows you to get reimbursed for 25% of certain types of work you do to your home. Exterior work like a new roof or painting, as well as window repairs, shoring up interior structural elements, and heating, ventilation, and plumbing work are all covered by the program. You need to spend at least $10,000 to be eligible and the tax credit won’t apply to costs above $40,000, but if your project qualifies, you should fill out the short application and claim your money.

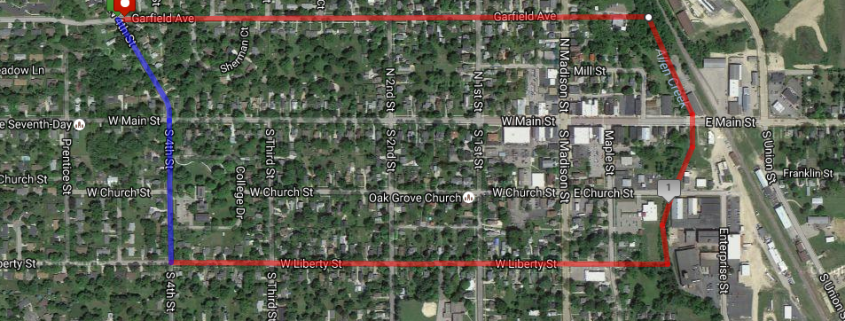

The first requirement for your home to be eligible is that it must be part of a nationally or state-recognized historic district. If you live within the borders of the picture that accompanies this article, you’re good. If you don’t, but your house is old, you might still be in luck–contact Jen Davel at the state historic office to find out for sure. Once you know that your house is eligible, snap a few pictures, tell the state what work you intend to do, and submit your application. It usually takes less than three weeks to see if you’re approved.

Once your work is done, prove it to the state by submitting final photos and a “Request for Certification of Completed Work,” and you’ll be all set to start receiving your tax credits. Assuming you owe state taxes–which you probably do–the credits will be as good as cash to the Wisconsin taxman.

Taking care of a historic house can be a pain (my dad has spent a decent part of his adult life alternating between scraping and applying paint to my parents’ 130-year-old house), but taking advantage of this tax credit can help take some of the sting away.

Leave a Reply

Want to join the discussion?Feel free to contribute!