Tag Archive for: revocable living trusts

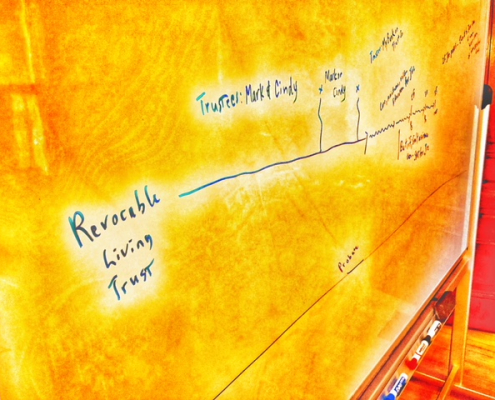

Revocable living trust and pour over will. Why do I need both?

/

0 Comments

The Question. Why do we have a pour over will when we…

News Flash: Beneficiary designations are a Big Deal

Use Care: Beneficiary Designations Override Your Will…

Trusts: How Do I Ascertain the Ascertainable?

We draft revocable living trusts on a regular basis here at Shannon…